Guidelines for Setting Tax Withholding Rates by Account Type: Taxable, Tax-Deferred, and Conversion Accounts

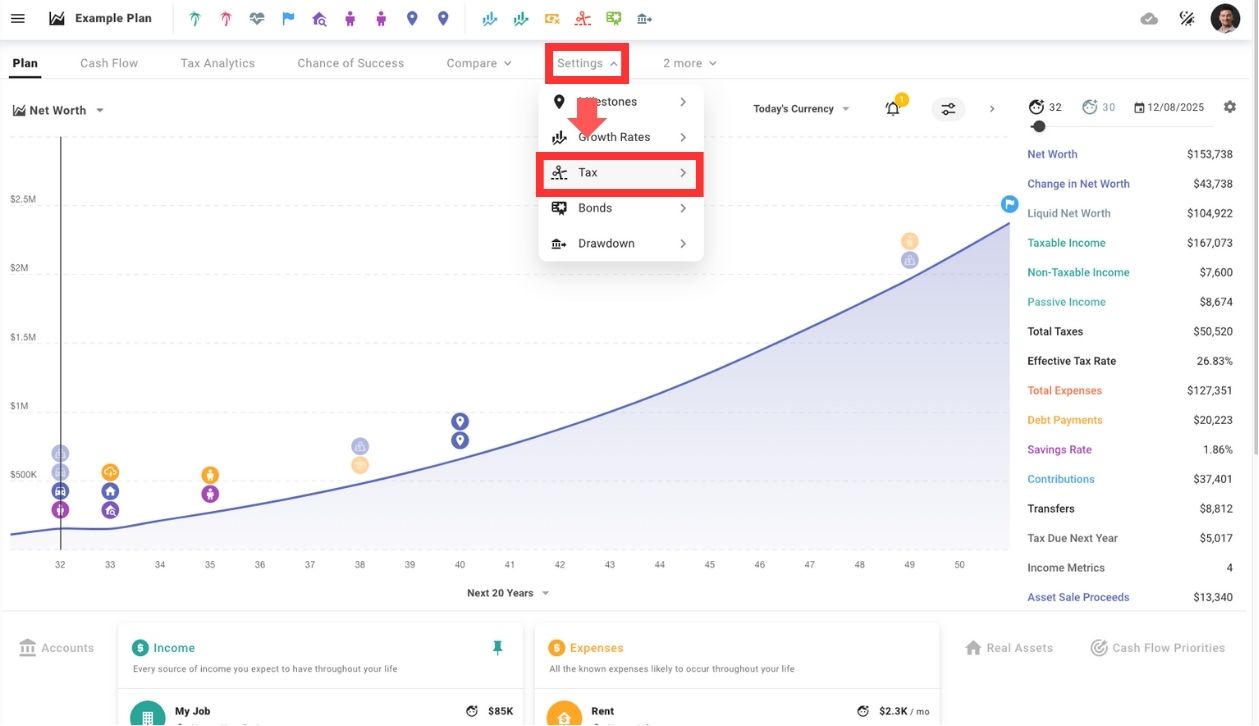

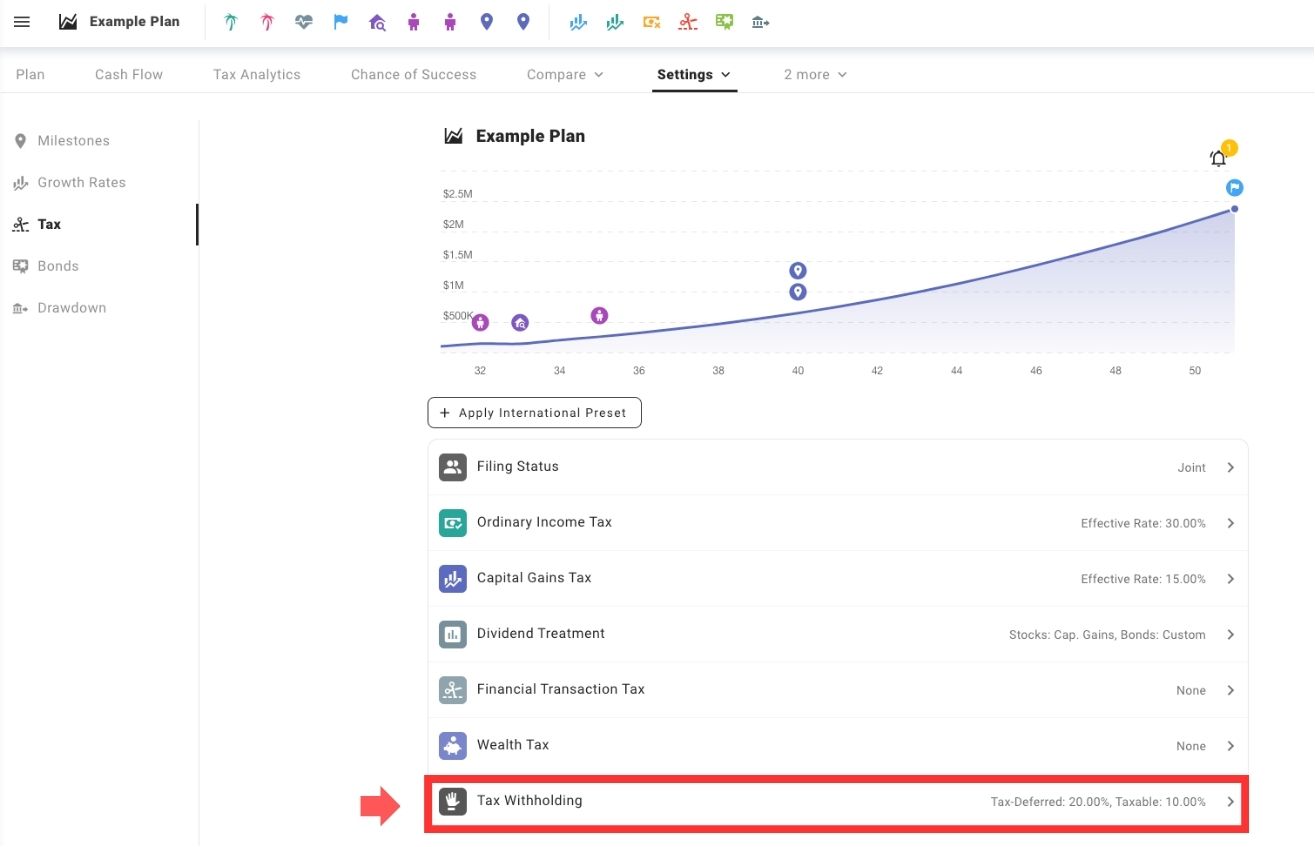

1. Access Tax Withholding Settings

Starting from the default Plan View, go to > Settings > Tax > Tax Withholding.

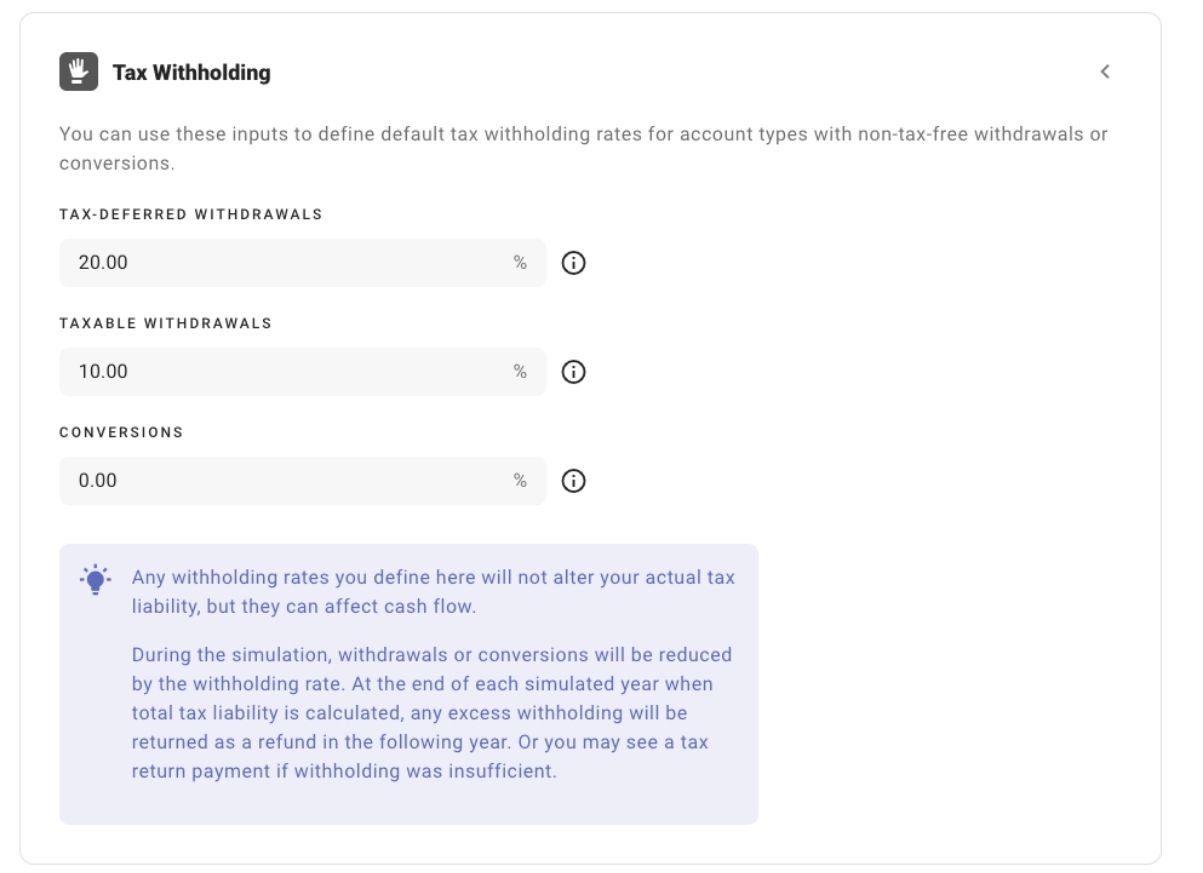

2. Set Withholding Rates by Account Type

ProjectionLab provides tax withholding options for two account types, along with Roth conversions. Customizing withholding rates for each account type helps ensure your projected cash flow aligns more accurately with real-world tax obligations throughout the year:

- Tax-Deferred Investments

- Taxable Investments

- Examples: Brokerage accounts (Robinhood, Vanguard, Schwab, etc.).

- Conversions

- Example: Roth conversions (e.g., moving assets from a traditional IRA to a Roth IRA).

- Note: the tax withheld will be deducted from the conversion amount

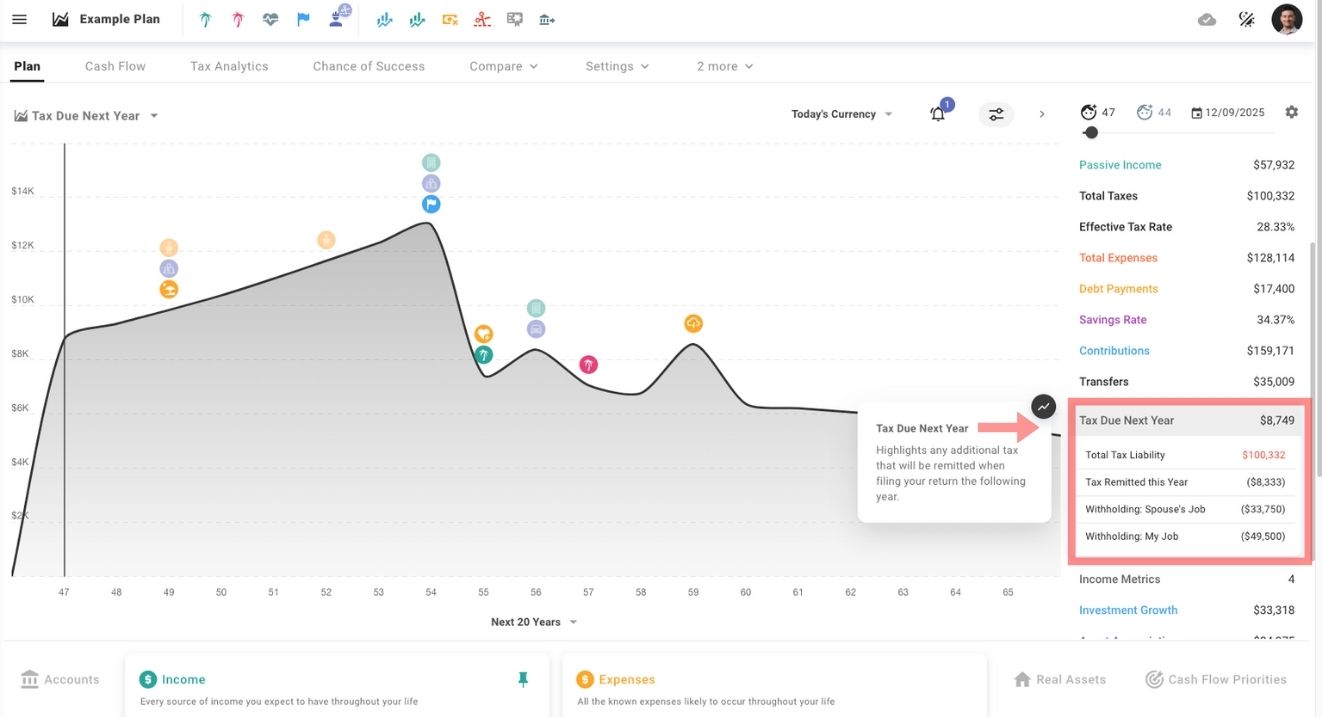

3. Adjust Withholding Rates to Optimize Cash Flow

Your defined rates don’t alter your actual tax liability but affect cash flow by:

- Adjusting withdrawals or conversion amounts during Plan years.

- Preventing unnecessary refunds from over-withholding or additional payments due to under-withholding at year-end.

Use Tax Withholding to evaluate the effects on cash flow and year-end tax outcomes. Adjust the rates as necessary to more accurately reflect your financial circumstances.

4. Change Withholding on Milestones

You can use the Milestone system in ProjectionLab to anchor points in your plan either directly to specific dates or ages, or conditionally in relation to other milestones. This allows you to adjust withholding levels across account types.

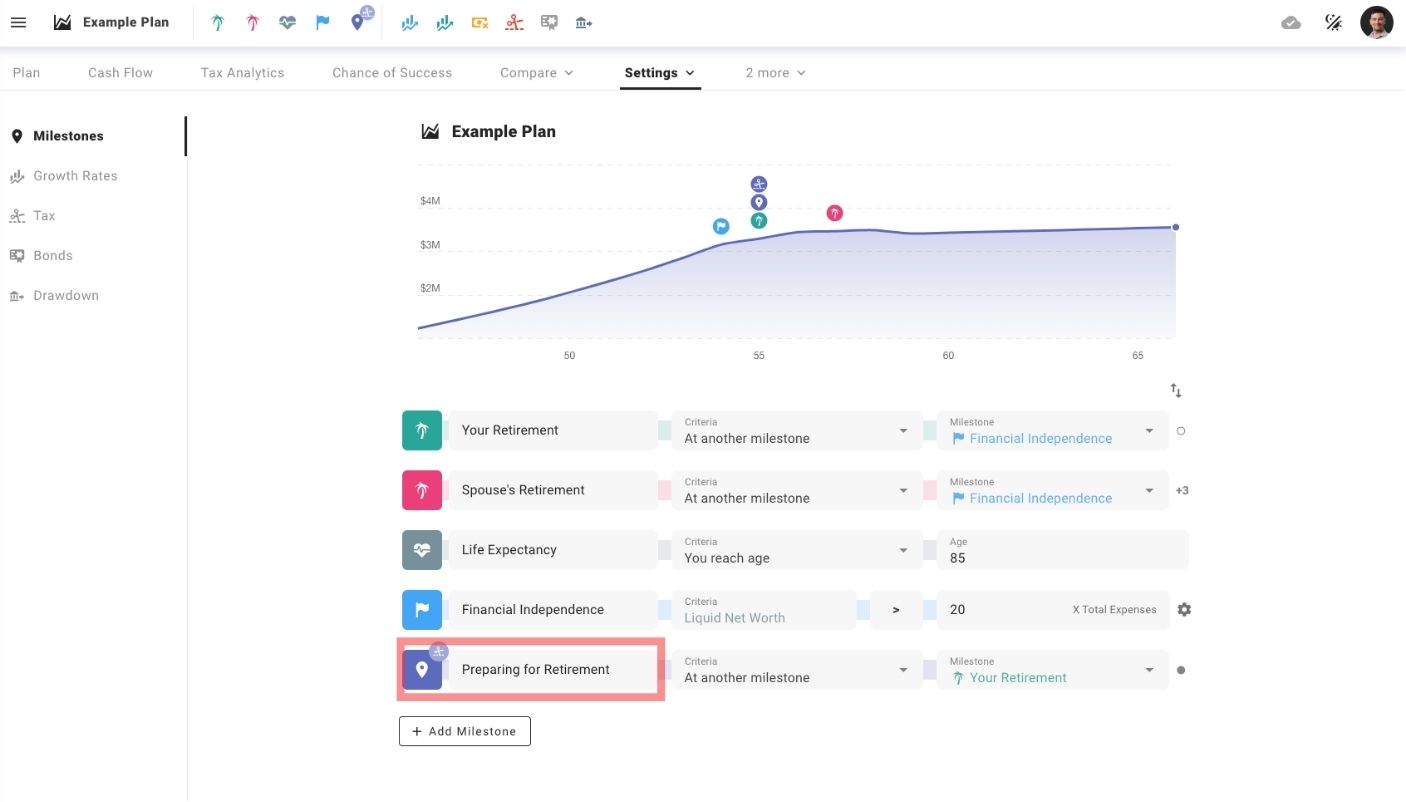

Create a Milestone

Set up a new milestone, e.g., a custom one like “Preparing for Retirement”.

Open the Milestone Settings

Click on the Milestone icon to access its settings.

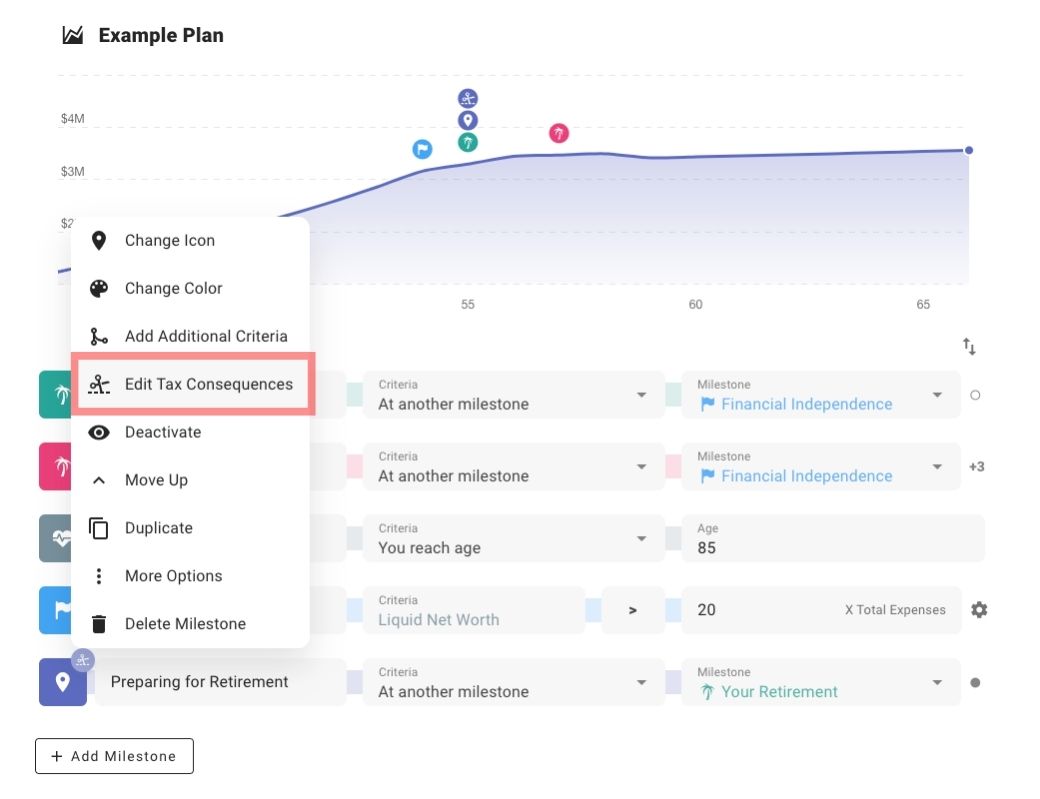

Select the “Edit Tax Consequences” Option

From the Milestone options, choose “Edit Tax Consequences.”

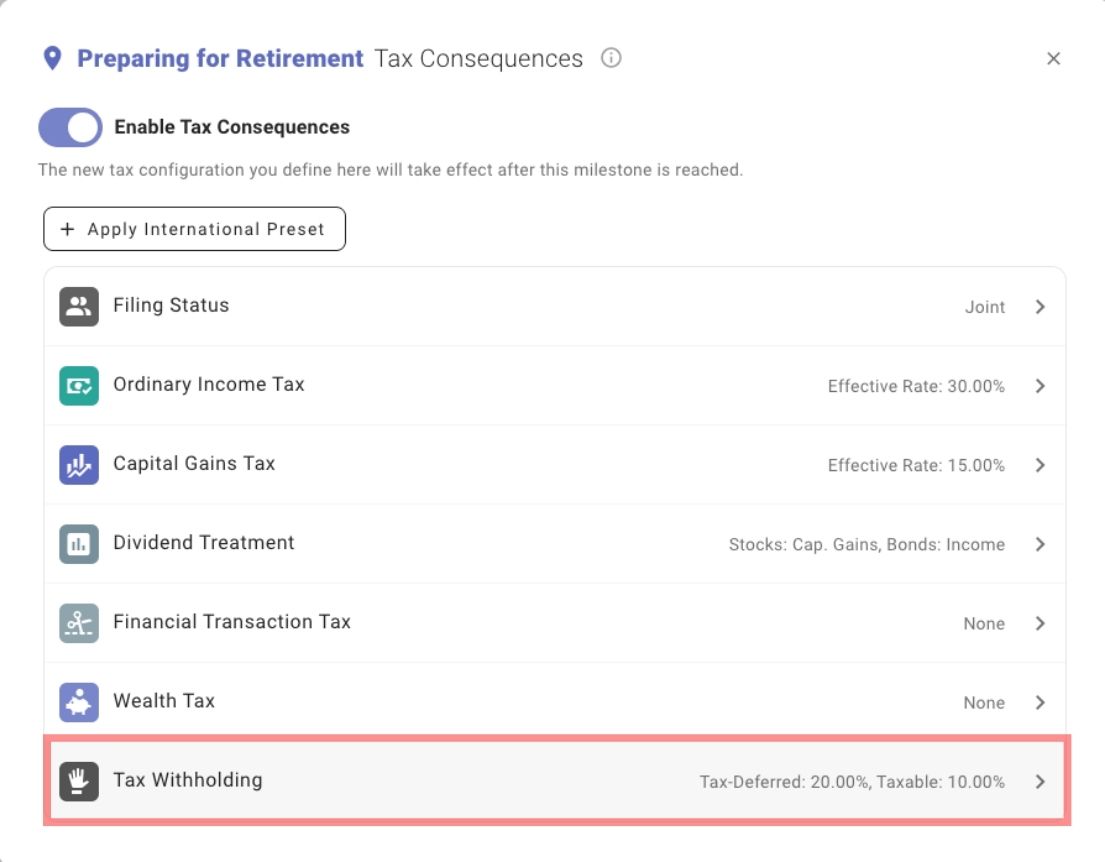

Navigate to ‘Tax Withholding’

Scroll down to the “Tax Withholding” section.

Adjust Withholding Settings

Modify the withholding levels according to your preferences.