How is tax calculated and visualized?

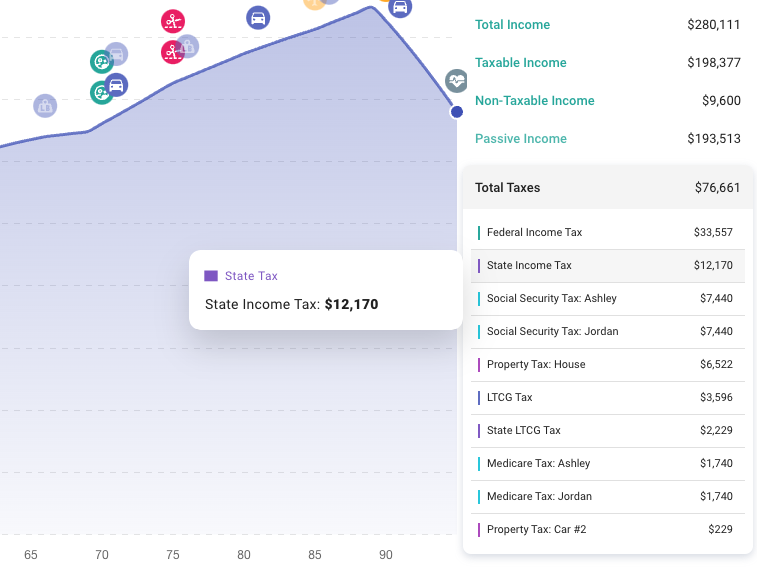

At the end of each simulated year, ProjectionLab computes your total tax liability based on everything that happened in that year. Total tax liability is reflected in the Total Taxes expansion panel in the yearly summary pane:

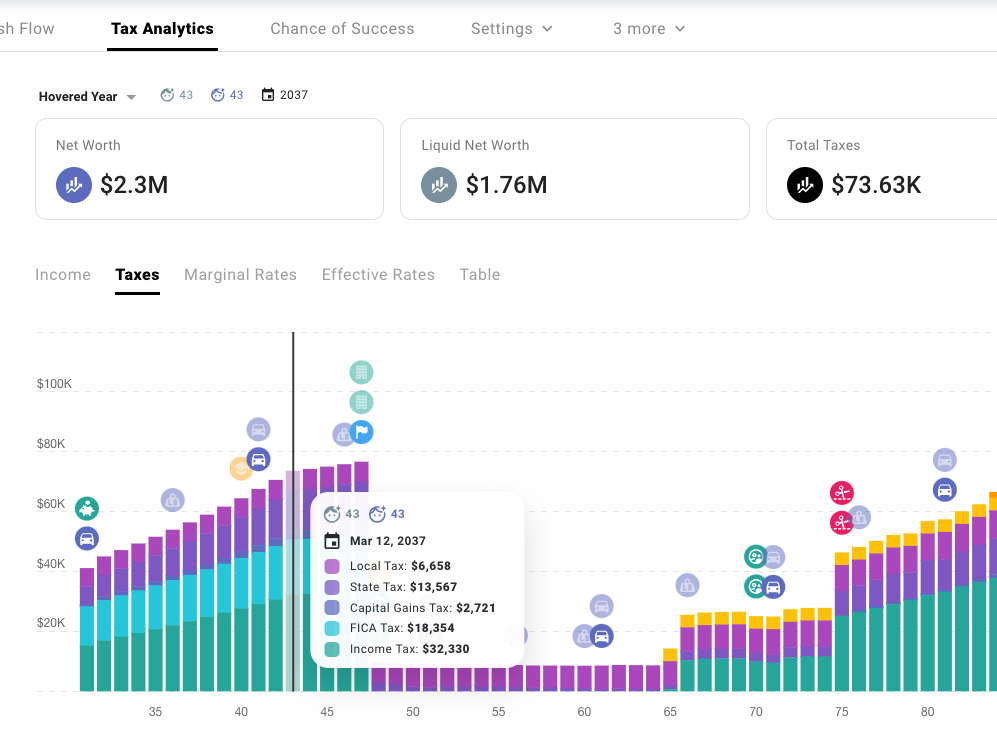

Total tax liability is also used for the breakdowns and visualizations on the Tax Analytics page:

However, total tax liability is not what you’ll see in the Sankey cash-flow chart. That chart depicts the underlying flows that occur like tax withholding, tax return payments and refunds.

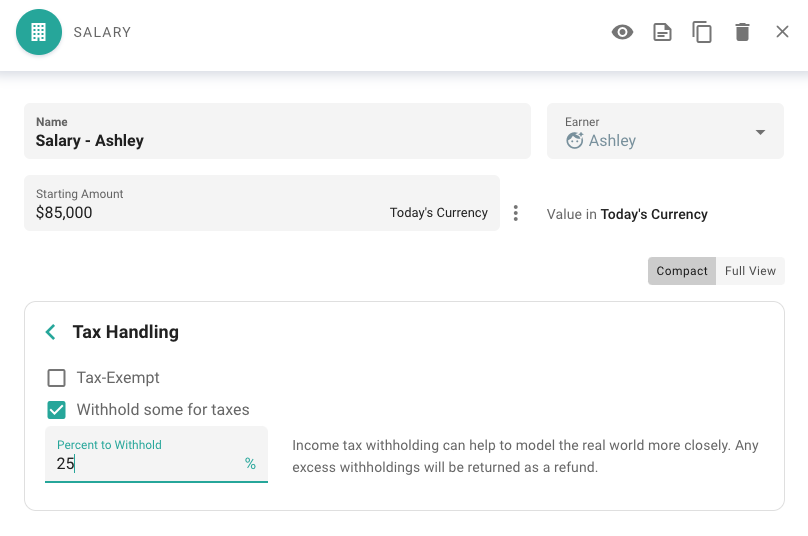

While tax liability is computed at the end of each simulated year, whether or not any tax actually gets collected and remitted during that year depends on how you have set up tax withholding on your income sources, which you’ll find in the Tax Handling subsection of the Income form.

For example:

After each year, ProjectionLab reconciles the total computed tax liability with how much tax withholding actually occurred, and then in the subsequent year you’ll either see a tax return payment or refund. This is mainly to try to mirror how things work in the real world, particularly in the US.

If you need to model a tax return payment that you know you’ll be paying in the real world in the first simulated year based on what happened in the past, just add a one-time expense.

Additional Tips

- ProjectionLab’s Tax Analytics and Quick Tips videos walk through how taxes are calculated in more detail.

- Join our Discord Community for examples and discussion about first‐year tax scenarios.