How does the simulation engine work and how do I interpret results?

In each simulated year, excess income or required drawdown is computed based on the relevant items in your plan for that year, such as income, withholding, expenses, debt payments, dividends, taxes due from the previous year, required minimum distributions, assets that generate rental income, and many other possibilities. Since yearly surplus/shortfall is computed automatically, this means you don’t manually define what is saved as you might in a more simplistic retirement calculator. If there is surplus income in a given year, it is saved/invested according to the order of your cash-flow priorities. Or if drawdown is required, it is performed based on your configured drawdown preferences in plan settings.

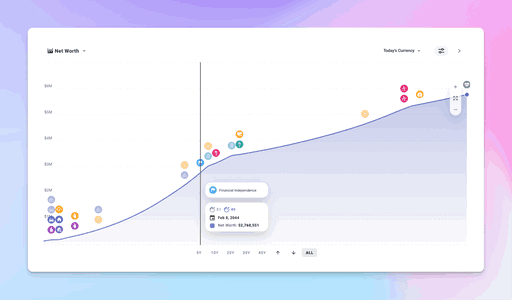

Simulation output is reported at the granularity of discrete years. Most plots will show an initial data point representing where you are today, followed by data points representing each following year. For instance, if you’re 28 now, and making a plan that projects from “now”, you’ll see a data point capturing where you are at this moment in time, followed by a point representing what happened in the next 365 days (i.e. age 28-29, the first simulated year), followed by age 29-30, etc. If you’re looking at a stacked bar chart, you can think of each bar as a kind of year-end report, and clicking any of them will open the yearly summary pane where you can examine the expansion panels to fully understand what happened in that year. Many questions about simulation logic can be answered by reviewing that output carefully, but for anything that puzzles you or you think the sim has calculated incorrectly, please let us know!