Account Transfers and When to Use Them

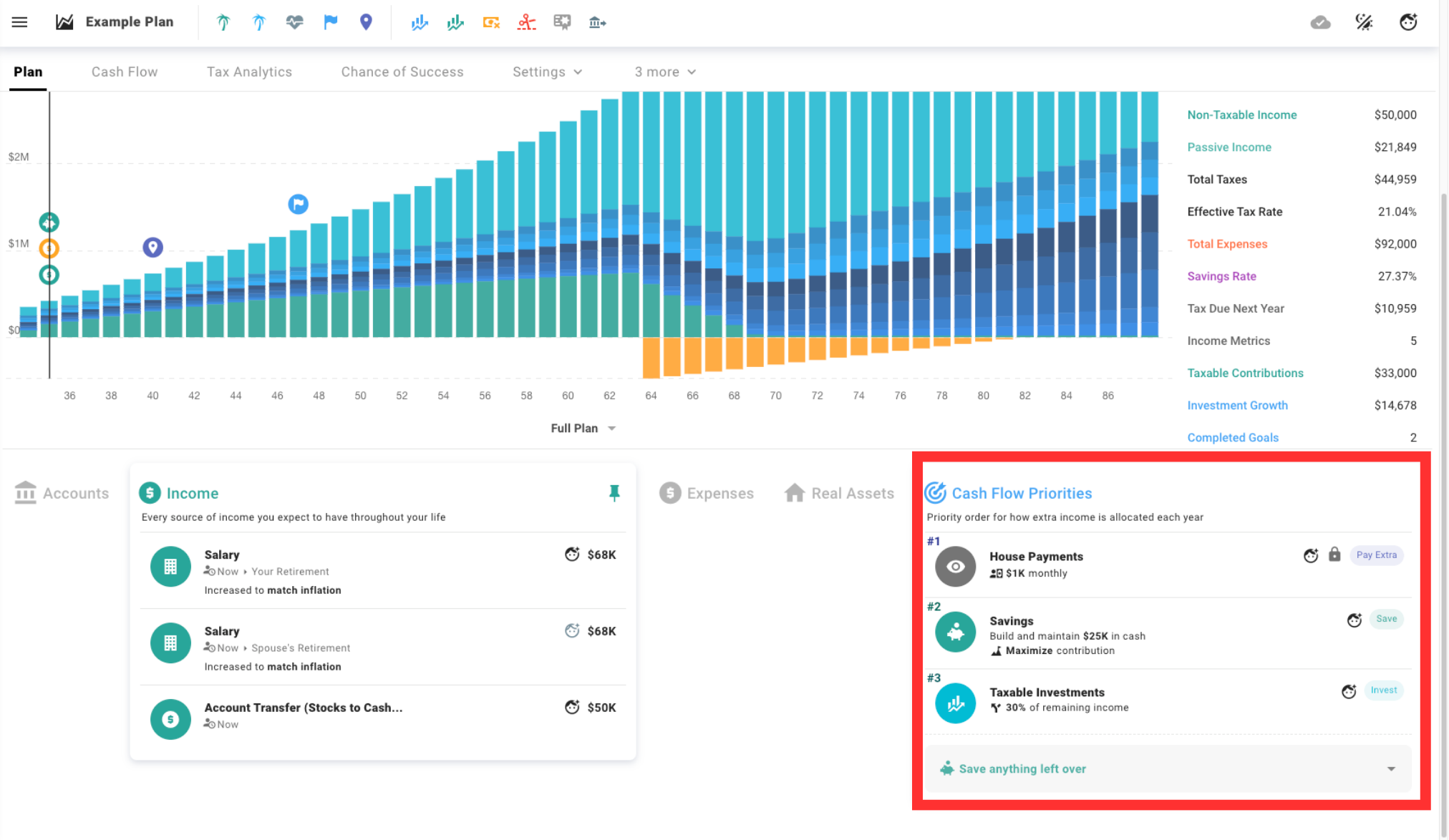

In this article, we will explore a less common scenario that extends beyond the typical use of Cash Flow Priorities, which you can find on the right side of your Plan screen.

When to Transfer Between Accounts

You should consider transferring between accounts when the existing Cash Flow Priorities don’t align with your specific allocation intentions or transfer requirements. This situation arises when you need to move funds between accounts in a way that differs from the default behavior of Cash Flow Priorities.

In essence, unless you have a specific reason to override the standard flow of funds in your plan, we recommend using Cash Flow Priorities to manage your inflows.

Account Transfers In a Nutshell

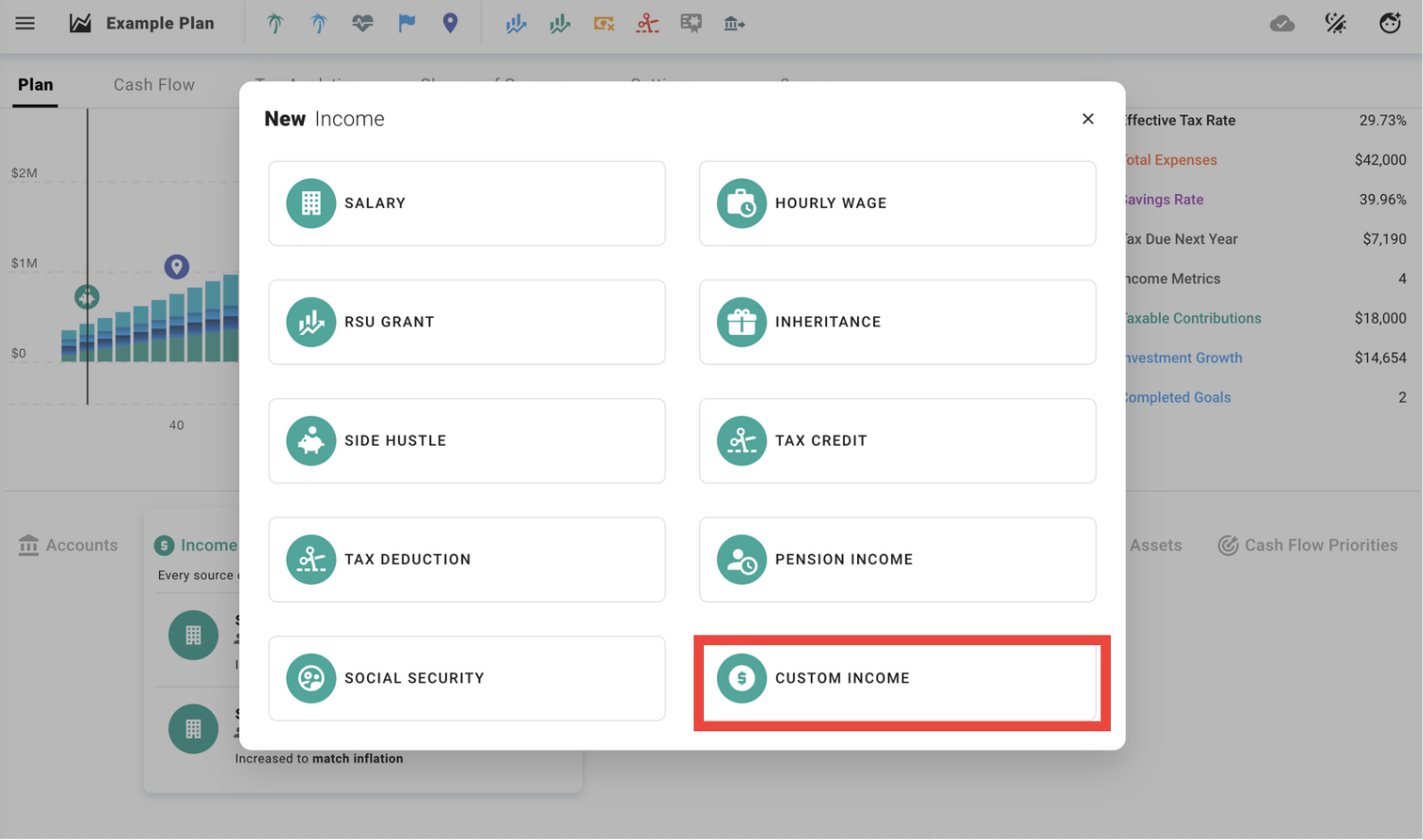

To transfer funds between accounts, create a pair of custom events: a Custom Income Event and a Custom Expense Event. Configure the Custom Income Event to add funds to the receiving account, while the Custom Expense Event should be set up to deduct funds from the source account. By linking these two events and ensuring they occur simultaneously for the same amount, you effectively simulate a transfer of funds from one account to another. See the video below for an example of this in action.

Account Transfers In Action

Step-by-Step Breakdown

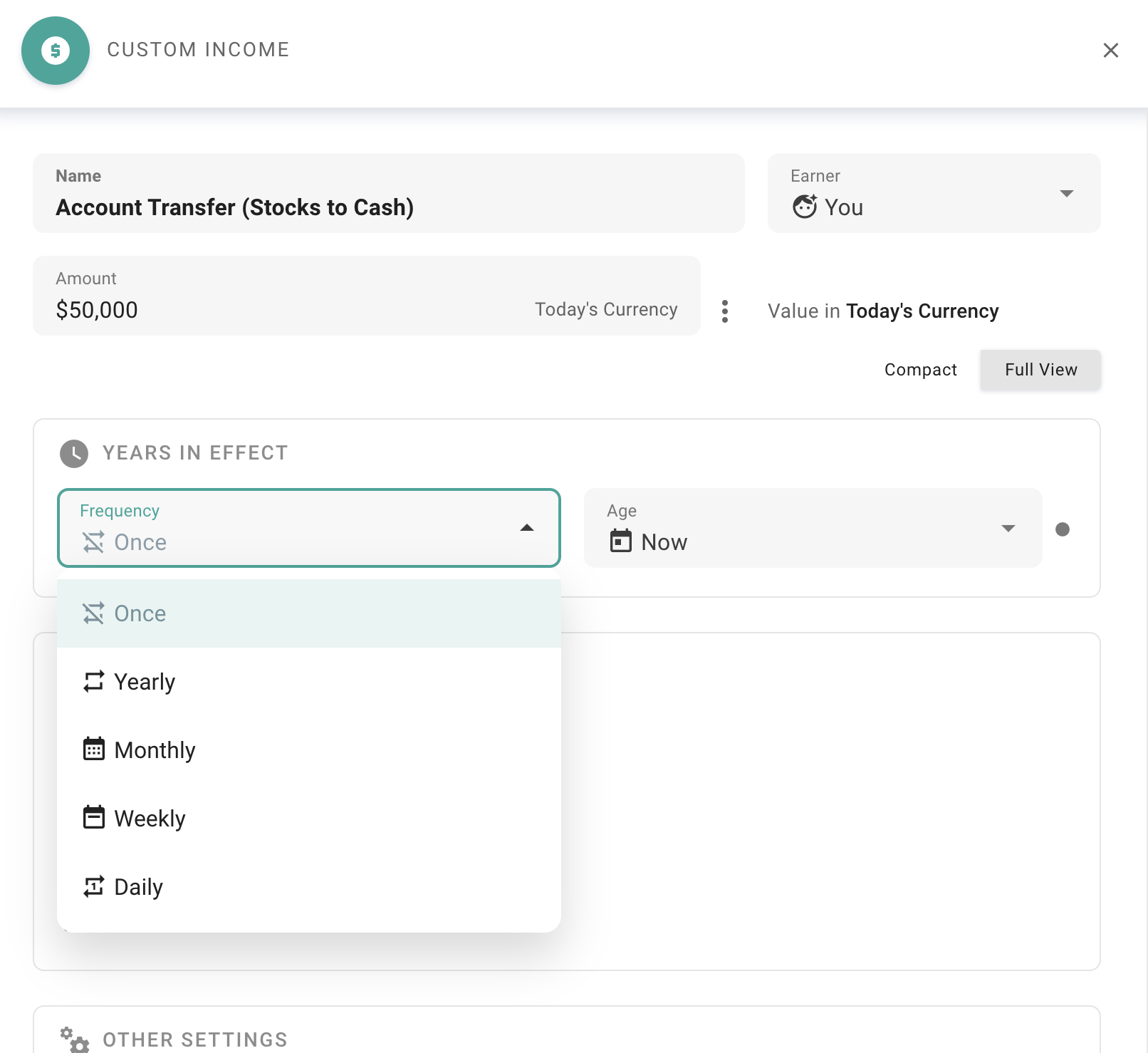

- Set Up a Custom Income Event

Create a Custom Income event as follows (e.g., “Recipient Savings Account”)

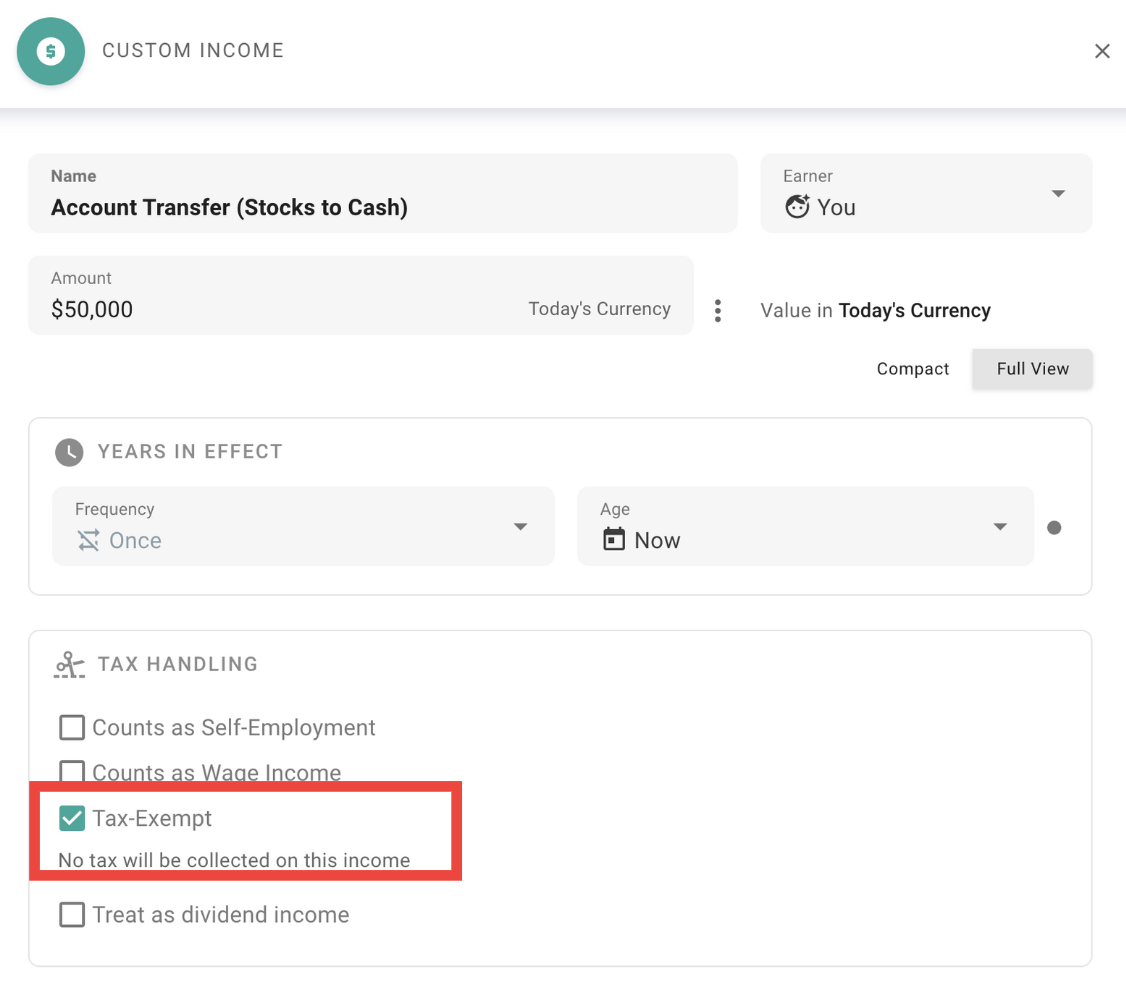

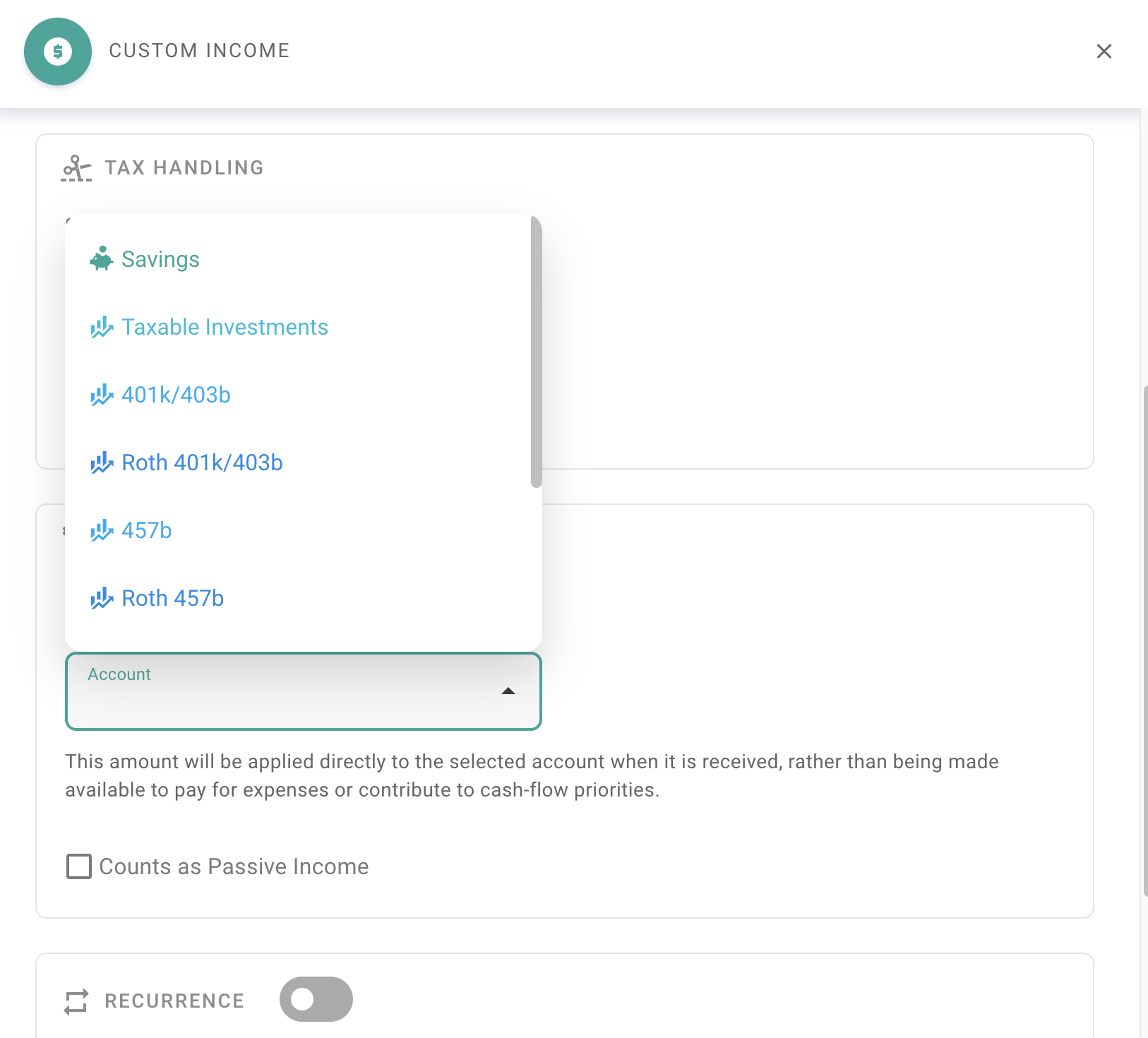

Classify the event as Tax-Exempt under Tax Handling (to avoid double taxation after creating the paired Custom Expense.)

Specify the amount and timing of the event.

In Other Settings, select to which Account you would like your income to go.

- Now that we have configured our Custom Income Event, it’s time to set up the corresponding Custom Expense Event.

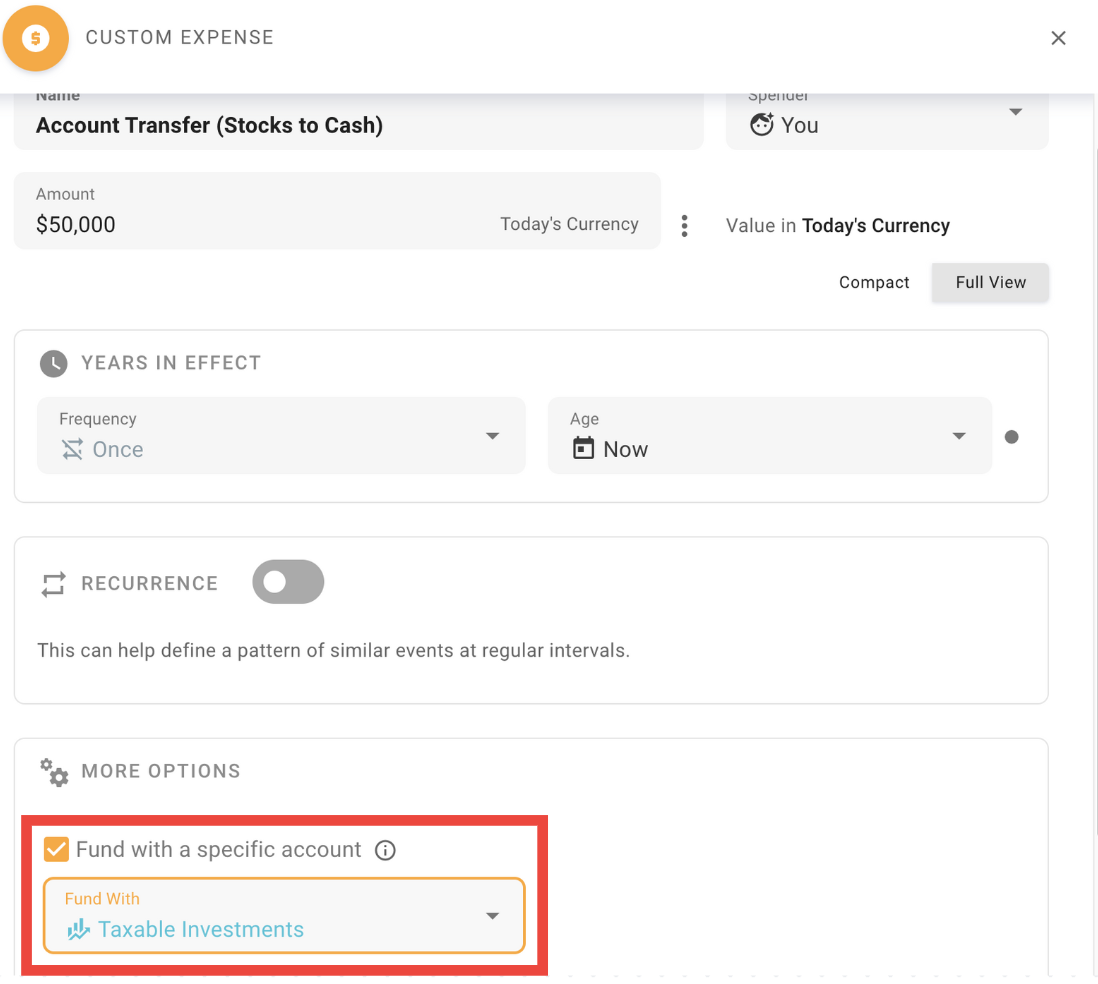

Create a Custom Expense Event that deducts from the source Account (e.g., “Taxable Investments”) over the same time interval as the Custom Income Event.

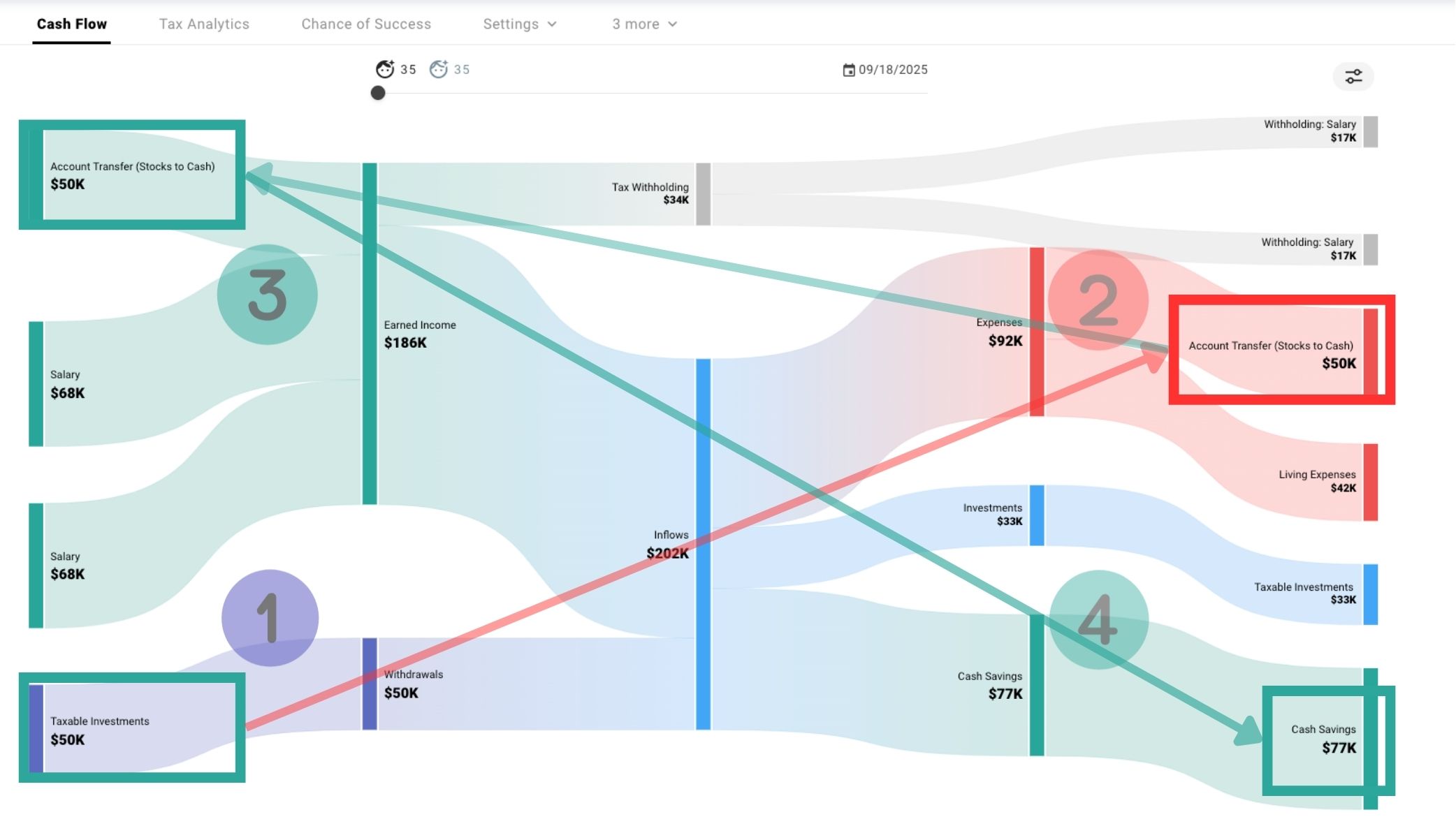

You may find it helpful to verify the flow of the Account Transfer in Cash Flow:

The scenario above illustrates how an account transfer operates: the designated origination account inflow (#1), such as Taxable Investments, funds the Custom Expense event (#2), which in turn supports the creation of the Custom Income event we’ve established (#3.) Finally, this funding is routed to the intended account, moving from inflow to outflow (#4.) While this example specifically directs funds to a cash account from taxable investments, this same method can be applied to transfer funds between other types of accounts.

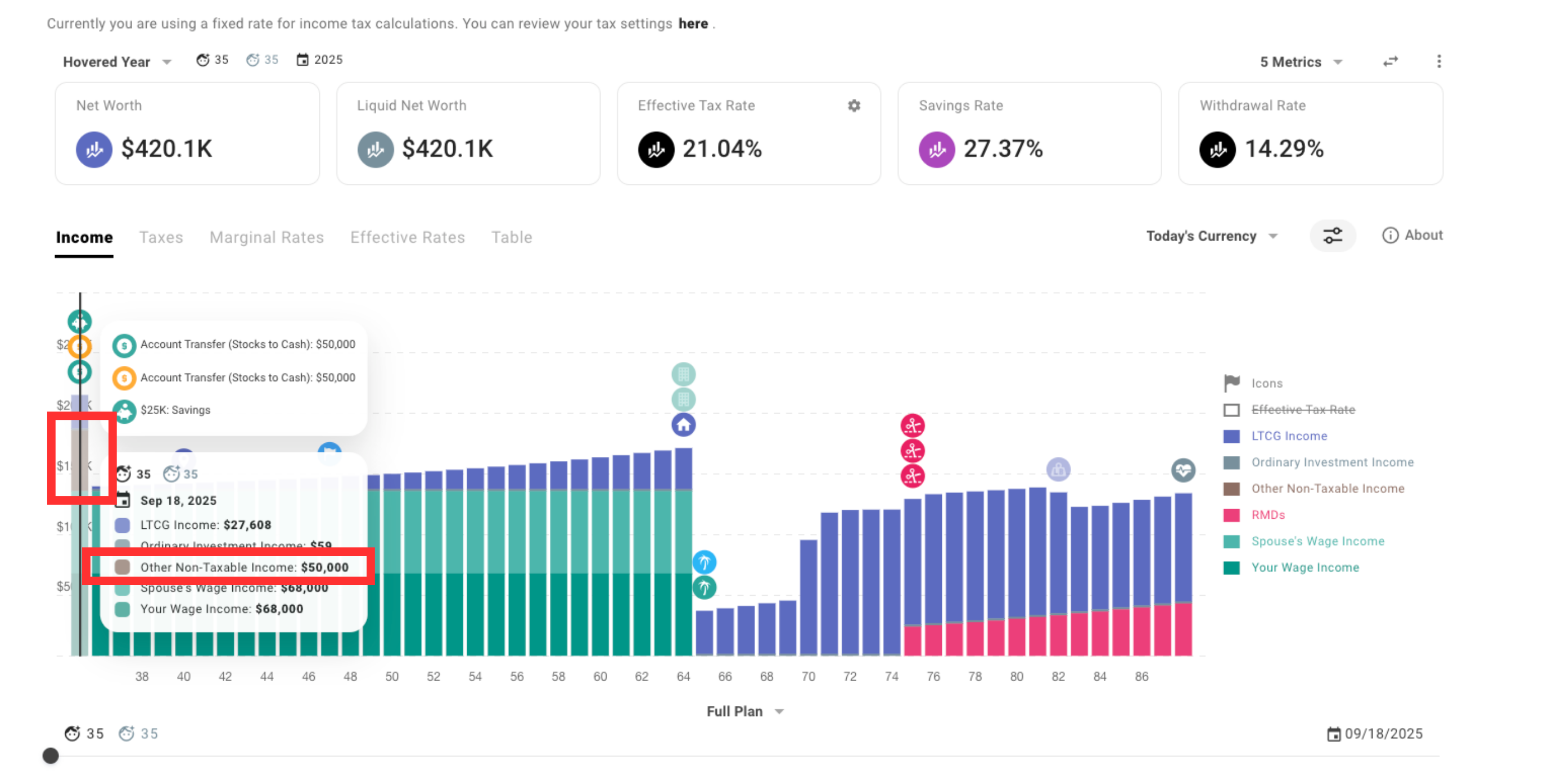

Please note that in the year when an Account Transfer takes place, Tax Analytics will show an artificially inflated income. However, tax calculations will still be accurate due to the Tax-Exempt label that was previously selected in the Custom Income event. This means that while the income may appear higher in the analytics, it will not impact your actual tax liability for the applicable period.