What's New in v4.3.0

New features and improvements in the latest version of ProjectionLab.

This is a big one! Our latest update is packed with new features and improvements to help you build even more flexible, accurate, and realistic financial plans.

From smarter tax modeling and inheritance tools to monthly event timing and more intuitive plan alignment, this release brings in a lot of ideas and feedback we’ve heard directly from all of you. We hope you enjoy it!

Here’s a closer look at what’s new.

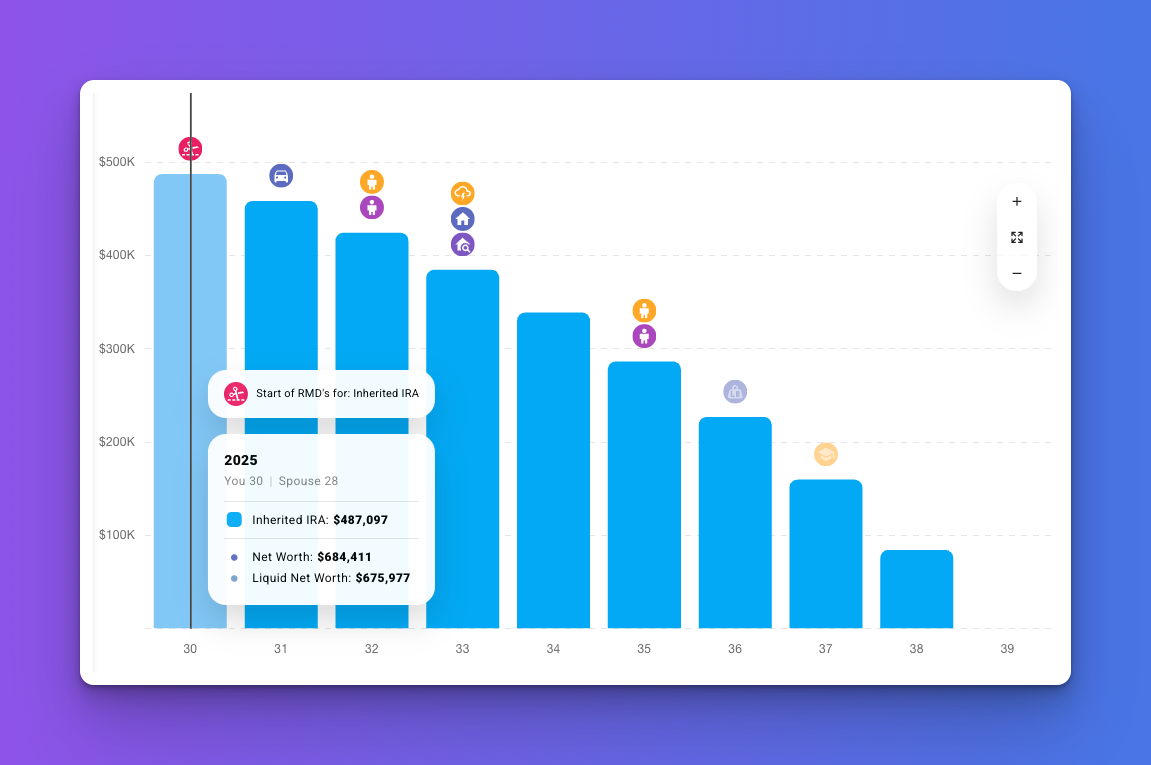

Added Support for Inherited IRAs

Inherited IRAs can now be fully modeled in your plans. You can now:

- Model both Traditional and Roth Inherited IRAs

- Choose between 10 year withdrawal windows, stretch RMDs, or a custom distribution schedule

If you have already received, or expect to receive, an inherited IRA, you can see exactly how it fits into your broader plan and optimize your withdrawal strategy and taxes.

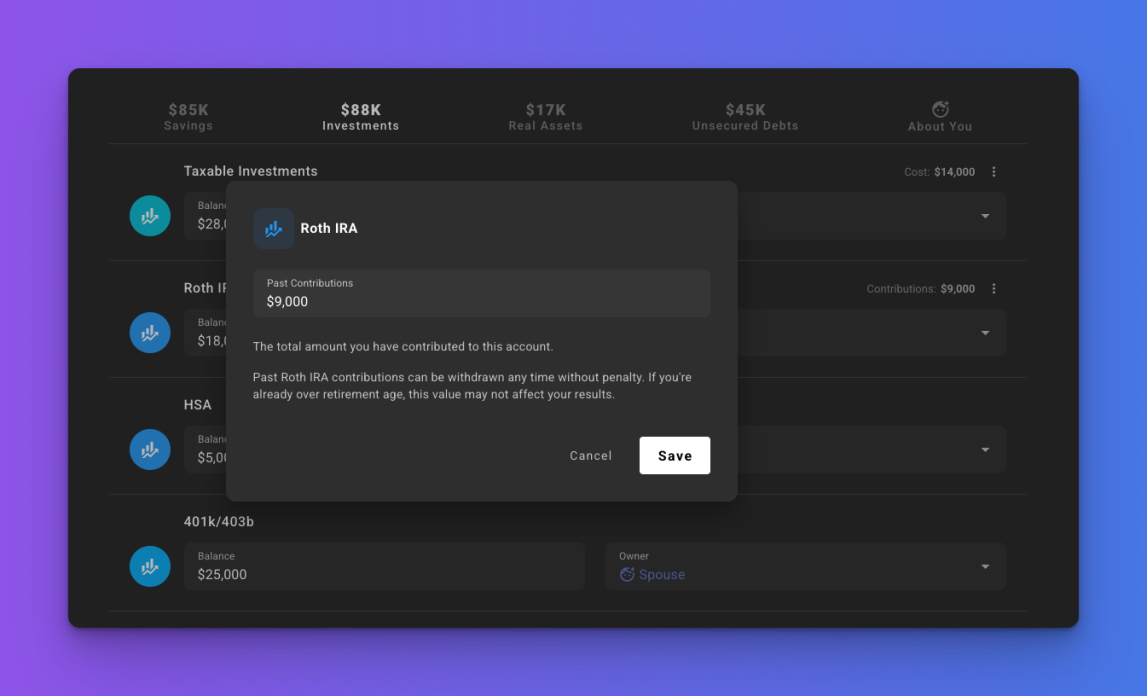

Easier Tracking of Cost Basis and Contributions

Cost basis and past contributions are now entered as dollar amounts in Current Finances, instead of as percentages within each account.

This makes it more intuitive and easier to keep your plans accurate and up to date. If you have multiple plans connected to Current Finances, you only need to update this information in one place. No more adjusting each plan manually when contributions change.

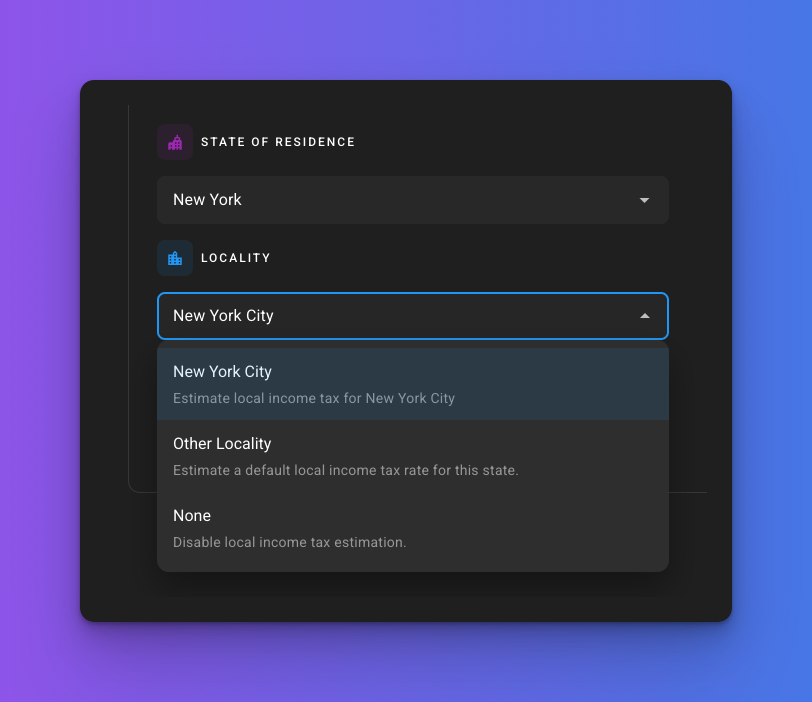

More Accurate State and Local Tax Modeling

It is now much easier to model the impact of state and local taxes in your plan. You can get a clearer picture of how these taxes affect your projections, especially if you live in a state or city with unique tax rules.

This update makes it easier to:

- Accurately model local income taxes and property taxes

- Reflect state taxability of Social Security, pensions, and retirement income

If you previously built workarounds for things like NYC local tax, California State Disability Insurance (SDI), or state tax rules around retirement income, you can now simplify your plan and trust that these scenarios are being modeled correctly.

More Precise Timing for Income, Expenses, and Events

You can now define monthly start and end dates for income streams, expenses, and milestones. Events will be prorated automatically, so your plan can more accurately reflect changes that happen mid-year.

For example, you can:

- Model a part time job, consulting project, or sabbatical

- Plan for temporary expenses such as childcare, tuition, or travel

- Reflect the true timing of life events in your cash flow projections

This gives you more flexibility to build plans that match how your financial life actually unfolds.

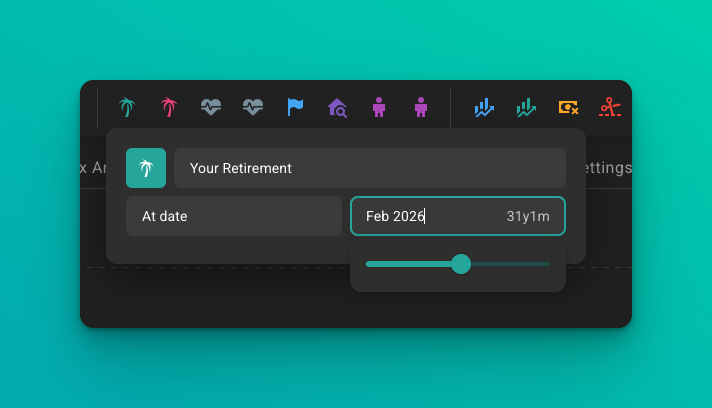

Calendar Year Alignment

Plans now align to the calendar year by default. We heard from many of you that rolling years were confusing and not how you typically think about years, so we hope this change makes things feel much more intuitive.

It also improves first year accuracy, especially for partial year events and continuous income streams. If your plan starts in the middle of a year, the impacts of events will be prorated accordingly. If you previously used a fixed date plan to achieve calendar year alignment, you can now switch back to a standard plan for a smoother experience.

For UK and Australian users, there are also built-in options to align plans to your local tax year.

Explore what’s new

That covers some of the highlights in v4.3.0, but there is more under the hood as well.

If you would like a quick walkthrough, we put together a short video:

You can also check out the full release notes here.

Whether you are updating an existing plan or building something new, we hope these improvements make it easier to model your financial life and explore new possibilities.